SOLUTIONS

IDa REMOTE KYC

The First NIST* Certified Remote KYC Solution in Turkey

Regulations redesigned Customer Onboarding and ID Verification processes. IDa is fully compliant with current BDDK and BTK regulations.

* The National Institute of Standards and Technology

Customers today expect that they can open a new account online

or recover their passwords only using their laptop or mobile.

It sounds simple, but it's not.

Financial institutions need to offer a fully Digital Identity Verification experience to avoid abandonment during the enrollment & reauthentication phase.

To offer this, you need a legal compliant Remote KYC solution.

SOLUTIONS

NIST CERTIFIED FACE RECOGNITION!

Optic Character

Recognition

Artificial

Intelligence

Deep

Learning

Face

Recognition

Near Field

Communication

Active & Passive

Authentication

Liveness

Detection

Time

Stamp

IDa REMOTE KYC

OPTION 1

SELF SERVICE KYC

ID Verification

• Verify ID documents (TC National ID, All Chip Passports)

• Check for authenticity and legitimacy

• Ensure document is not forged or altered

• Driven by AI, OCR, MRZ & NFC

NIST Certified Face Verification

• Biometric matching of selfie, ID document image

and biometric photo from chip

Liveness check

• The process verifies that its the same person

doing the verification as the owner of the ID

OPTION 2

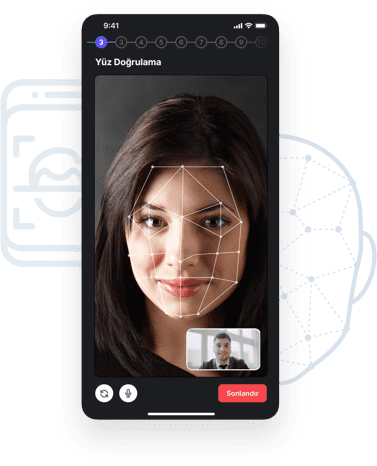

VIDEO IDENTIFICATION

Video Agent Moderation

• WebRTC based person to person video conference

• Guideness and directions for KYC steps

• Security Questions

• Manuel controls via back office management panel

• Face to face consent

Video agent helps customer to complete;

ID Verification

NIST Certified Face Verification

Liveness Check

IDa VIDEO

IDENTIFICATION PROCESS

1. Customer Application

• Fill in the application form

• Give instant consent for video recording and personal data sharing

2. OTP Verification

• An SMS OTP is sent to the customer phone

• Customer enters this OTP to the screen during the call

• The OTP is validated which ends the process

3. NFC ID Verification

• Get ID information and biometric photo from the chip via NFC

4. Live Video Connection

• Live video connection starts

• Agent asks security questions

5. OCR ID Verification

• Customer shows both sides of the ID to the camera

• Baraka KYC verifies the ID and gets ID data using OCR

• Gets MRZ info

6. Face Verification

• Baraka KYC gets a face image from the screen for verification

• Checks this image with the photo on the ID card or in the Chip to verify both photos belong to the same person

7. Liveness Check

• For liveness check, customer is required for smiling, eye blink or move his / her head to one side to the other side

8. Closing The Call & Build Reports

• Call is ended by the operator

• All data collected and verified including the record of the call is reported to the client immediately

WHY CHOOSE IDa

REMOTE KYC SOLUTION?

Cloud / On Premise

IDa Remote KYC is designed to work either connecting the application with remote servers (cloud) where all the information could be accessed through an API, or connecting to the client’s own servers (on-premise). We adapt to your needs!

Modular Design

Designed in such a way that each IDa Remote KYC piece and functionality can meet your project needs and requirements. IDa Remote KYC is easily adaptable to your project, compliance, and particularities of your business processes like digital onboarding or password recovery. Easily integrable, with a frictionless user experience and completely modular so you can integrate it your way.

SDK / White Label App

We offer flexible options like a SDK to be embedded to your company’s app or you can use Baraka KYC App as a white label solution.

Multi Platform

A cross-platform solution compatible with Android, iOS, Web.